Why Traditional Moving Averages Fail to Lead the Market

Every trader wants to catch trends early, but most indicators show up late.

Most traders start their journey with traditional moving averages like SMA and EMA. They are simple, visual, and easy to understand. However, over time, one major drawback becomes obvious — these indicators react after the market has already moved.

Because moving averages are calculated using past prices, they naturally lag behind real market action. This delay often leads to late entries, missed opportunities, and poor risk–reward setups, especially in fast-moving markets.

The Problem with EMA Crossovers

EMA crossover strategies are extremely popular, but popularity doesn’t make them perfect.

The core issue is that EMA crossovers depend entirely on historical price data. A crossover only happens once the move is already established. By the time confirmation appears, a significant part of the trend is often over.

In live market conditions, this makes EMA crossovers reactive rather than predictive.

Img: 1.1 – EMA crossover example

What Is Sheshnag in Brahmastra AI?

Sheshnag is the first core feature of the Brahmastra AI Indicator. It is designed as a volume-based leading moving average, created specifically to solve the lagging nature of traditional EMAs.

Although Sheshnag visually looks like a moving average line, its internal logic works very differently. It focuses on market intent, not just price movement.

Not Just Another Moving Average: Sheshnag as a Volume-Based Leading EMA

Unlike traditional moving averages that rely only on price history, Sheshnag integrates volume dynamics directly into its calculation.

This allows it to respond to how strongly the market is participating in a move, rather than reacting after the move has already happened.

In simple words, Sheshnag listens to both price and participation.

How Volume Converts a Traditional EMA into a Leading Moving Average

When volume is added into the moving average logic, the behavior of the indicator changes completely.

Instead of waiting for confirmation from past prices, Sheshnag adjusts itself based on how much interest and commitment is present in the current move. This is what transforms it from a lagging EMA into a leading moving average.

Why Volume Matters in Trend Detection

Volume represents conviction. It shows whether a move is supported by real participation or driven by temporary noise.

By analyzing volume along with price, Sheshnag is able to sense whether a trend is likely to continue or fail. This early insight helps traders stay aligned with genuine market strength instead of reacting late.

Benefits of the Sheshnag Volume-Integrated Approach

The biggest advantage of Sheshnag is clarity.

By filtering out low-volume price movements, it helps traders avoid false breakouts and weak trends. This volume-integrated approach keeps the trader focused on moves that actually matter.

Clearer Bias and Earlier Trend Identification

With Sheshnag on the chart, traders experience:

- Clearer directional bias

- Earlier trend recognition

- Better decision-making under pressure

- Improved timing in fast-moving markets

Img: 1.2 – Sheshnag MA showing price and volume relationship

Understanding Sheshnag Before Using It on Charts

Sheshnag works across all timeframes, making it suitable for scalping, intraday, and swing trading.

However, there is one important requirement — the instrument must have volume data.

Why Volume Is Mandatory for Sheshnag

Sheshnag is a volume-integrated leading EMA. It correlates price movement with volume participation to understand market intent.

If an instrument does not provide volume data, this relationship cannot be calculated. As a result, Sheshnag will not appear on the chart.

The Meaning Behind the Name “Sheshnag”

The name Sheshnag comes from its spiritual symbolism. In mythology, Sheshnag represents stability, balance, and support.

This meaning aligns perfectly with the role Sheshnag plays inside Brahmastra AI — acting as a stable guide that helps traders stay aligned with the true direction of the market instead of reacting emotionally to price noise.

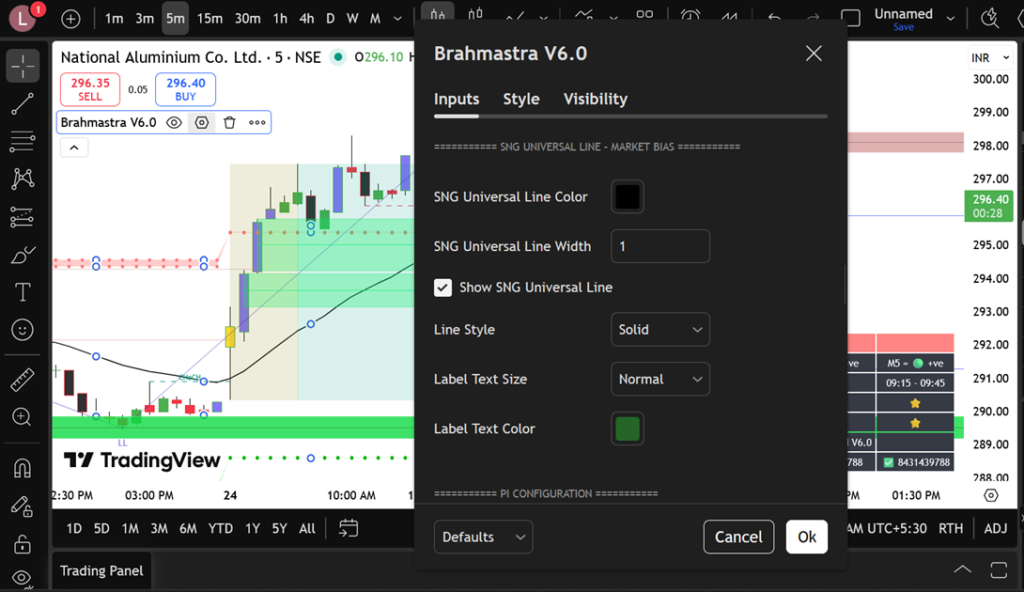

Setting Up Sheshnag on Your Chart

Before using Sheshnag for trading decisions, proper visual setup is important.

Indicator Settings

- Choose a color that stands out clearly on your chart

- Adjust line thickness for better visibility

- Ensure Sheshnag is clearly distinguishable from candles

Once set, you can start applying Sheshnag’s price–volume logic confidently.

Img: 2.1 – Sheshnag settings in the indicator

Primary Use Case of Sheshnag: Candle Closings

Sheshnag is primarily used by analyzing how candles close relative to it.

There are two important types of candle closings:

- 60% Candle Closing

- 100% Candle Closing

These help identify cautious zones, confirmations, and high-probability trade opportunities.

Img: 2.2 – 60% & 100% candle closings above Sheshnag

60% Candle Closing Logic

Short Trade Logic (Downside)

When the market is in an uptrend and starts pulling back:

- A candle closes below Sheshnag

- At least 60% of its body is below the line

This candle becomes a cautious candle. Mark its high and low.

Confirmation:

- If the next candle breaks the low first, confirmation is achieved

Execution:

- Entry after confirmation

- Stop loss at the high of the 60% candle

- Target: 1:1 risk–reward

After 1:1 is achieved, profits are locked and further trade management is done using RPZ, IBZ, LIQ, and other Brahmastra AI stations.

Img: 3.1 – 60% candle short-side example

Long Trade Logic (Upside)

In a downtrend pullback:

- A candle closes above Sheshnag

- At least 60% of its body is above the line

This is treated as a cautious candle.

Confirmation:

- If the next candle breaks the high first, the setup is confirmed.

Execution:

- Entry after confirmation

- Stop loss at the low of the 60% candle

- Target: 1:1 risk–reward

After achieving 1:1:

- Lock profits

- Wait for price interaction with RPZ, IBZ, LIQ, and other zones

Img: 3.2 – 60% candle long-side example

100% Candle Closing Logic

The 100% candle closing logic is applied when the 60% condition fails.

When to Use 100% Closing

If a candle closes near Sheshnag but does not meet the 60% body condition, the setup is considered weak.

In such cases, traders wait for a stronger confirmation.

What Is a 100% Candle Closing?

A 100% closing means:

- The entire candle body is fully above Sheshnag (for long trades)

- Or fully below Sheshnag (for short trades)

Wicks are ignored — only the candle body matters, except in the case of doji candles.

Trade Execution Using 100% Closing

Once a valid 100% candle closing occurs:

- Mark the candle high and low

- Wait for the confirmation candle

- Apply the same rules as 60% logic:

- Entry after confirmation

- Stop loss at candle extreme

- Target at 1:1

- Further management using Brahmastra AI zones

Img: 4.1 – 100% candle long-side example

Key Takeaway

Sheshnag is not a signal-generating indicator.

It is a directional and confirmation-based guide that works best when combined with:

- Proper candle closing logic

- Structured risk management

- Other Brahmastra AI stations like RPZ, IBZ, and LIQ

When used with discipline, Sheshnag helps traders align with real market strength and execute trades with clarity and confidence.

Join the Brahmastra Trading Ecosystem

If you want to apply market structure, supply & demand, and smart money logic consistently in real markets, connect with us below:

🔔 Telegram – Free Learning & Market Updates

👉 https://t.me/trAding_Learner

🌐 Official Website – Indicator & Resources

👉 https://tradingbrahmastra.com

🎓 LMS Portal – Structured Trading Education

👉 https://lms.tradingbrahmastra.com

▶️ YouTube Channel – Practical Market Education

👉 https://www.youtube.com/@trading_Learner

⚠️ Disclaimer

Trading involves risk. All content shared on this website, Telegram channel, LMS portal, and YouTube channel is for educational purposes only and should not be considered financial advice. Always manage risk responsibly and trade according to your own understanding.